ST. JOHN'S, N.L. -- Newfoundland and Labrador's credit rating has been downgraded by a major agency in a report citing risks from a high debt level, the over-budget Muskrat Falls hydroelectric project and an unusually ambitious plan to cut spending.

On Thursday, Moody's Investors Service downgraded the province's long-term senior unsecured debt ratings to A1 from AA3. It also changed the outlook for the province's rating to stable from negative.

In its rationale, the credit rating agency pointed to the weakened financial health of Crown corporation Nalcor Energy, suffering from the runaway costs of the $12.7-billion Muskrat Falls project.

Moody's also said it expects the province's debt burden -- expressed as net direct and indirect debt as a share of revenue -- to climb, peaking at 257 per cent of revenue by 2021 and stabilizing at around 250 per cent by 2022.

"This level is elevated among Canadian and international peers and is higher than previously forecasted by Moody's," the agency's statement read.

It noted that the province's plan to return to surplus by 2023 relies on a "highly ambitious target for a Canadian province," requiring expenditures to fall by 7.3 per cent between 2019 and 2023.

Newfoundland and Labrador reports the highest interest expense of all Canadian provinces, Moody's said, measuring 12.8 per cent of revenue and expected to rise to 14.9 per cent by 2022.

The report also pointed to the volatile state of the province's revenue stream coming from its offshore oil and gas industry, saying this dependence hampers long-term planning.

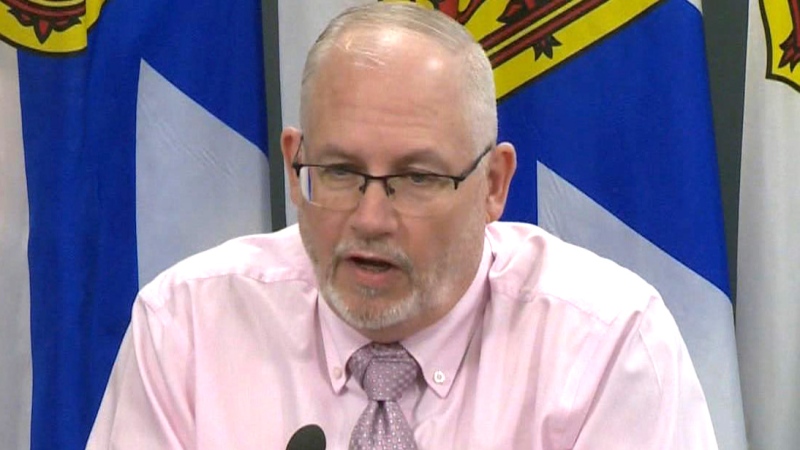

Liberal Finance Minister Tom Osborne said Thursday he's not alarmed by the change, but he said people need to be realistic about the immense challenges posed by Muskrat Falls.

"We need to recognize the fiscal challenges we faced when we came to office, and in particular a hydroelectric project that was spiralling out of control," Osborne said.

The Muskrat Falls dam on Labrador's Lower Churchill River, sanctioned by a previous Progressive Conservative government, now accounts for about one-third of the province's direct and indirect debt. The project's cost and schedule overruns are the subject of an ongoing public inquiry.

Osborne urged people not to be alarmed at the news and expressed confidence in his government's financial plan.

Since being re-elected with a minority status in May, the Liberals' plans now depend on collaboration with other elected members.

"The message I believe that they're (Moody's) sending today is this is not a time for increased spending," Osborne said. "It is a time for collaboration and it's a time for fiscal stability."

The minister said the news, anticipated since last year, has not surprised the province's lenders, adding that he is hopeful other agencies will keep the province's rating stable.

Moody's also raised doubts about the future success of the government's plans to mitigate rising power rates once Muskrat Falls begins providing full power, saying the current plans have not yet proven sufficient.

"Should rate mitigation efforts not succeed, either the province would have to offer support to Nalcor or electricity rates would need to rise, which would hinder economic activity across the province. Both of these outcomes would be credit negative," Moody's statement read.

Osborne said the plan will not change, and he challenged people running for federal office this fall to speak up about the plan to tackle rising power rates in the province.