FREDERICTON -- Critics are panning the $8.9 billion budget unveiled by the New Brunswick government Tuesday, saying the Liberals should have opted for spending controls rather than tax hikes and a descent into even greater debt.

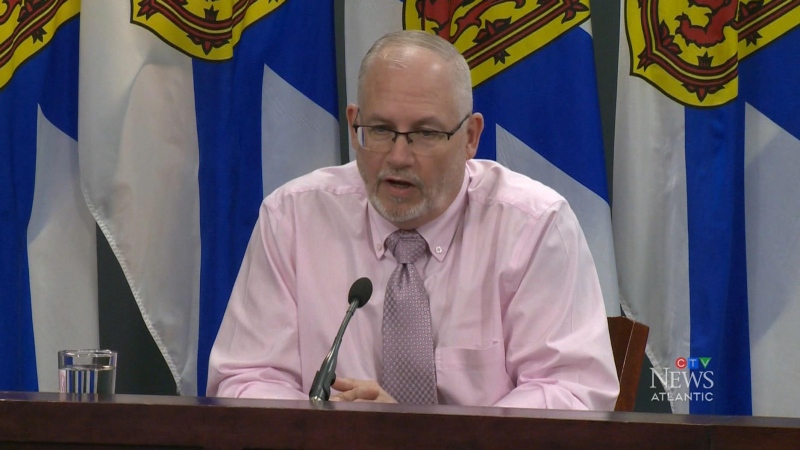

The budget, tabled by Finance Minister Roger Melanson, raises the HST and corporate taxes while cutting the size of the civil service by more than 1,000 positions and privatizing some services.

"It's really telling when you see the government come out and raise taxes by the amount they did, go through the massive cuts to the civil service and services, and we still end up with a huge deficit," said Progressive Conservative Leader Bruce Fitch Tuesday.

Melanson says the government's objective was to take a balanced approach with measures suggested by the year-long strategic program review.

"These measures are balanced with $296 million in expenditure reductions and $293 million in revenue measures," Melanson said.

The province is forecast to run a deficit of $347 million this year, while the net debt is expected to hit $13.4 billion by the end of March 2017 - nearly $18,000 for every man, woman and child in the province.

Fitch said the Liberal government could have avoided such drastic measures by controlling its spending and People's Alliance Party Leader Kris Austin agreed, calling the budget "a typical tax and spend budget with a side order of cuts."

Melanson said the province is expected to achieve a balanced budget by 2020-21, but NDP Leader Dominic Cardy was skeptical.

"There's absolutely no way anyone can make a projection like that right now with the chaos we're seeing in international markets, with our economy being thrown off by the collapse in the oil and gas sector around the world, so I think those predictions are extremely dangerous," Cardy said.

The government will increase the harmonized sales tax to 15 per cent from 13 per cent effective July 1, generating roughly $300 million in additional revenues each year.

"New Brunswick will now have the same HST rate as Nova Scotia and a rate that is only slightly higher than Quebec's combined rate of 14.975 per cent," said Melanson.

To lessen the impact, the government will provide a refundable provincial credit for lower-income individuals and families.

The corporate income tax rate will increase to 14 per cent from 12 per cent and the tax on tobacco products will be increased by 6.52 cents per cigarette over the next two years, with an initial increase of 3.26 cents effective at midnight Tuesday and a second increase of 3.26 cents on Feb. 1, 2017.

"This will eventually bring the tax rate from 19 cents to 25.52 cents, the same as Nova Scotia," Melanson told the legislature.

Kevin Lacey, Atlantic director of the Canadian Taxpayers Federation said raising taxes is not the way to grow the economy now.

"At a time when we need to create jobs and get the economy rolling, this budget does the exact opposite by raising taxes and making New Brunswick uncompetitive," he said.

The government is also planning a major reorganization of services and the civil service in an effort to eliminate duplication and find efficiencies.

The number of managers in the senior service will be reduced by 30 per cent, or more than 180 positions. Non-core functions within the department of Transportation and Infrastructure will be privatized, impacting nearly 200 casual positions during construction season.

The government operates more than 40 contact centres around the province which will be consolidated into four regional business centres, while non-medical laboratory services will also be consolidated.

The Gagetown ferry will be eliminated, and the visitor information centres in Cape Jourimain and Campobello will be closed due to low usage.

In total, Melanson said 1,300 positions will be eliminated from the civil service over the next five years.

"This is an opportunity as government to look for attrition and to right-size, and to look at how we can have a more efficient public service," Melanson said.

Alex Furlong, regional director of the Canadian Labour Congress, said labour leaders need to sit down and study the complete budget before offering much comment, but said cuts to the civil service will hurt.

"When you look at 1,300 jobs, that's direct jobs, but you have to look at indirect jobs and the impact to communities," he said. "It's not a good budget for labour."

Melanson said the government will sell some properties while privatizing the operation of the Mactaquac Golf Course and Larry's Gulch -- the government's fishing lodge.

He said the government has been able to avoid introducing highway tolls or making deep cuts to health and education. However, while 200 teachers are expected to retire this year, 150 teachers will be hired to maintain or improve the student-teacher ratio.