HALIFAX -- Two key architects behind a sophisticated multi-million-dollar stock market scheme have been found guilty of manipulating the share price of Knowledge House Inc., nearly 17 years after the Halifax e-learning company's dramatic collapse.

Nova Scotia Supreme Court Justice Kevin Coady handed down the verdict Friday on former Knowledge House president and CEO Daniel Potter and lawyer Blois Colpitts.

In his 207-page ruling, Coady said the pair knowingly carried out fraudulent activities in a regulated securities market.

"Their goal was to artificially maintain the (Knowledge House) stock price while they secured new investors, who, as a result of the defendants' conduct, would be making investment decisions based on a misleading impression of the level of demand for the stock," he wrote.

"The defendants acted with an intent to defraud."

Knowledge House was once a high-flying developer of educational software, trading on the Toronto Stock Exchange before its breathtaking collapse in 2001.

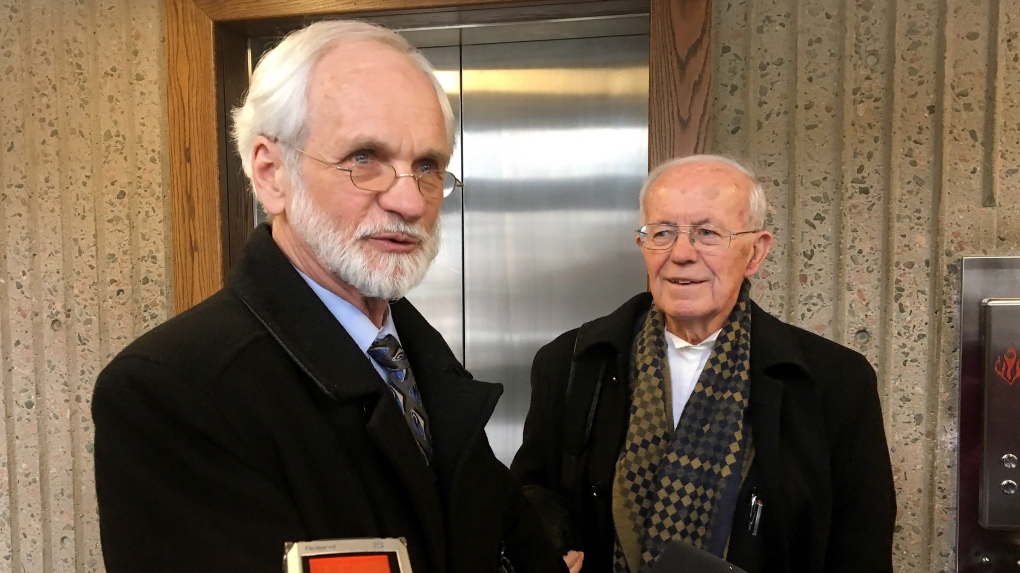

The former chief executive of the disgraced tech firm said he wasn't surprised by the decision.

"I can't say I'm surprised, given the whole history of the thing," Potter told reporters outside the courtroom. "There is a very long and almost convoluted history and one can't be surprised about anything in this process."

He added: "Today is not my day to respond, it's just to take in the message of the court and we'll take it from there. It's been a long process."

The trial began in November 2015 and heard from 75 witnesses over more than 160 court days, and 184 exhibits were received -- including thousands of documents.

A sentencing hearing has been scheduled for May 22.

Mark Covan, one of three federal Crown attorneys handling the criminal trial, said the case is one of the largest fraud prosecutions in the province's history.

"It's been a significant case to prosecute," he said. "Commercial crime cases take significant resources to investigate and significant resources to prosecute, because they tend to be complex and challenging cases."

In his decision, Coady said the pair's actions spanned an 18-month period, which included the dot-com crash.

The conspirators spent millions buying up half the company's shares that crossed the exchange, he said, noting that they "succeeded in artificially maintaining the share price."

While the judge found Potter and Colpitts guilty on all five counts of the indictment, he entered convictions only on the first two counts.

Meanwhile, Coady also released a 54-page decision dismissing the pair's charter application on the grounds of delays before and after they were charged, finding that their rights had not been infringed during the lengthy proceeding.

"The defendants in this case were not the victims of delay," he wrote in the decision. "Indeed, they went to great efforts throughout the entirety of this prosecution to create it."

Coady added: "It would be a miscarriage of justice to reward their efforts by staying the charges against them for delay."

The downfall of Knowledge House, once the star of the East Coast tech scene, has dominated discussion in the business and investment community in Nova Scotia for 17 years, Coady said in his introduction to the saga.

The company was founded in 1984, and was reinvented under Potter in the late 1990s to become a learning and information technology company, he said.

The vision was "the complete overhaul of the K-12 and post-secondary education system through the introduction of collaborative, problem-based learning programs," Coady said.

Knowledge House quickly began acquiring companies through share options, and cashing in on government contracts.

By late 1999, the company had grown to 120 employees, and was closely followed in the local press.

Shares in Knowledge House, which began trading publicly on the Toronto Stock Exchange for a few cents, skyrocketed to more than $9.

But in 2001, a series of events led the stock price to plummet, from which it never recovered, Coady explained.

Without financing to keep the doors open or make payroll, the company ceased operations on Sept. 13, 2001.

Coady described the ensuing investigation and trial as "extremely lengthy, complex and challenging."

Colpitts and Potter were among three people charged in 2011 with conspiracy to commit fraud, fraud affecting the public market and fraud over $5,000, following a seven-year-long RCMP investigation.

The third, former National Bank Financial stockbroker Bruce Elliott Clarke, was sentenced in April 2016 to three years in jail after pleading guilty to conspiring to affect Knowledge House's share price and defrauding a trust fund established by the United Brotherhood of Carpenters and Joiners of America of more than $5,000.