With Grand Manan's only bank set to close, residents of the N.B. island are fighting to keep it open

Residents on the New Brunswick island of Grand Manan are rallying to keep their village’s only bank open.

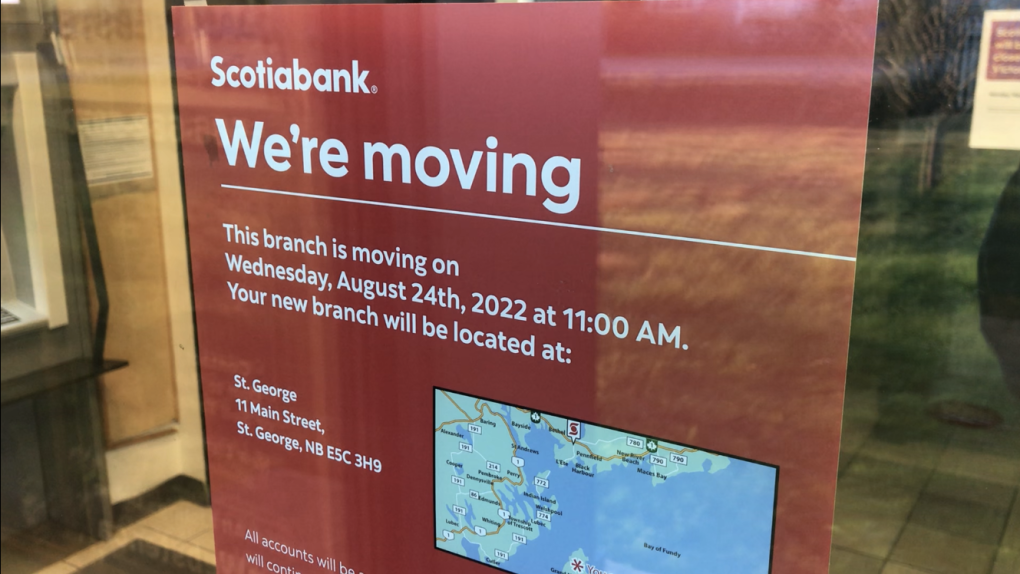

The Bank of Nova Scotia, or Scotiabank, notified customers of its plans to leave Grand Manan in January. The closure of the bank branch, along with its automated banking machine, is scheduled for Aug. 24.

Residents say they have many questions about why the bank is leaving Grand Manan after operating on the island for well over a century.

Scotiabank held a virtual meeting with island customers earlier this year.

“It was really a time to encourage all of us to go electronic banking,” says resident Gregg Russell.

Several residents felt their specific questions and concerns weren’t answered at the meeting.

“It almost seemed scripted,” says resident Selena Leonard. “He just kept repeating the same answer every time a question was asked.”

Scotiabank wouldn’t agree to an interview request from CTV News.

In a written statement, Scotiabank says, “We did not make this decision lightly and we understand that this will have an impact on the people and community of Grand Manan.”

Scotiabank’s written statement also says it regularly reviews customer numbers in market areas along with the ways customers are doing banking. Scotiabank wouldn’t share those specific details for Grand Manan.

CONCERNS FROM CONVENIENCE TO PUBLIC SAFETY

Scotiabank says customer accounts from the Grand Manan branch will be transferred to its branch in St. George, N.B.

Grand Manan’s only regular connection to the mainland is a one-and-a-half hour ferry trip each way. The St. George branch is about 20 kilometres from the ferry’s landing in Blacks Harbour, N.B.

Island resident Charlotte Frost says if she took the island’s first morning ferry to do banking on the mainland, the earliest she’d be able to return to Grand Manan is late that afternoon.

“It’s not as simple as they make it out to be,” she says.

Other residents say the cost of leaving the island to do banking, including the ferry fee and rising gas prices, will cause hardship.

“It’s going to cost me 60 dollars to get 40 in cash from the bank,” says Russell. “It doesn’t make a lot of sense.”

Another worry is the potential for island residents and businesses to have large quantities of cash on hand.

“You won’t be travelling two or three days a week to go to the mainland to do your banking,” says Leonard, who also owns two eateries on the island. “I’m fearful too of more temptations for break-ins because people are going to know that you can’t take it to the bank. So you’re going to have to keep it somewhere.”

HOPES FOR A DECISION REVERSAL

In its written statement, Scotiabank says it’s focused on helping customers make the transition to online and telephone banking.

Scotiabank wouldn’t share how many employees are affected by the branch’s closure in Grand Manan, nor what their future with the company would be.

Grand Manan residents are still holding out hope for Scotiabank to change its mind.

On a recent trip to Toronto, Russell held a one-man protest outside Scotiabank’s corporate offices.

“I spent two hours talking to many, many people who could not believe what was happening,” says Russell, who tried unsuccessfully to schedule a meeting with corporate officials.

“I said, it’s funny, when you want my money everyone will talk to me. When I have a complaint, nobody will talk to me.”

A protest at Scotiabank’s Grand Manan branch is scheduled for Friday. Russell says more protests are being organized both on and off the island.

BANK BRANCH CLOSURES A GROWING TREND

Grand Manan’s bank closure may present unique challenges, but it’s also part of a growing trend.

According to the Canadian Bankers Association, the number of bank branches across the Maritime region has been gone down in recent years. Between 2016 and 2020, New Brunswick lost 10 bank branches (from 152 to 142). Nova Scotia recorded a decline of seven bank branches (from 192 to 185), while Prince Edward Island lost two (from 27 to 25).

The only banks in Chipman, N.B., and Hartland, N.B., left those communities in that time.

In all, a total of 407 bank branches have disappeared across Canada between 2016 and 2020 -- from 6,190 bank branches down to 5,783, according to the Canadian Bankers Association.

CTVNews.ca Top Stories

Mexico president says Canada has a 'very serious' fentanyl problem

Foreign Affairs Minister Mélanie Joly is not escalating a war of words with Mexico, after the Mexican president criticized Canada's culture and its framing of border issues.

South Korea's opposition party urges Yoon to resign or face impeachment over martial law decree

South Korea’s main opposition party on Wednesday urged President Yoon Suk Yeol to resign immediately or face impeachment, hours after Yoon ended short-lived martial law that prompted troops to encircle parliament before lawmakers voted to lift it.

Trump making 'joke' about Canada becoming 51st state is 'reassuring': Ambassador Hillman

Canada’s ambassador to the U.S. insists it’s a good sign U.S. president-elect Donald Trump feels 'comfortable' joking with Canadian officials, including Prime Minister Justin Trudeau.

NDP won't support Conservative non-confidence motion that quotes Singh

NDP Leader Jagmeet Singh says he won't play Conservative Leader Pierre Poilievre's games by voting to bring down the government on an upcoming non-confidence motion.

Man severely injured saving his wife from a polar bear attack in the Far North

A man was severely injured Tuesday morning when he leaped onto a polar bear to protect his wife from being mauled in the Far North community of Fort Severn.

Canada Post strike: Kids no longer need to mail their letters to Santa by the end of the week

Canada Post says it has removed the deadline for its Santa Claus letter program amid an ongoing national workers' strike that has halted mail delivery leading up to the holiday season.

Quebec doctors who refuse to stay in public system for 5 years face $200K fine per day

Quebec's health minister has tabled a bill that would force new doctors trained in the province to spend the first five years of their careers working in Quebec's public health network.

Freeland says it was 'right choice' for her not to attend Mar-a-Lago dinner with Trump

Deputy Prime Minister and Finance Minister Chrystia Freeland says it was 'the right choice' for her not to attend the surprise dinner with Prime Minister Justin Trudeau at Mar-a-Lago with U.S. president-elect Donald Trump on Friday night.

'Sleeping with the enemy': Mistrial in B.C. sex assault case over Crown dating paralegal

The B.C. Supreme Court has ordered a new trial for a man convicted of sexual assault after he learned his defence lawyer's paralegal was dating the Crown prosecutor during his trial.